In a significant shift in U.S. trade policy, President Donald Trump announced on March 4, 2025, the implementation of reciprocal tariffs targeting countries with high tariffs on American goods, notably including India. This move aims to address trade imbalances and promote fairer trade practices.

Details of the Reciprocal Tariffs

Effective April 2, 2025, the U.S. began imposing tariffs that mirror the duties its exports face abroad. For India, this resulted in a 27% tariff on its exports to the U.S. This percentage reflects the disparity between India’s higher tariffs on U.S. goods compared to the relatively lower U.S. tariffs on Indian products.

How Trump is wrong in charging 26% reciprocal tariffs to India?

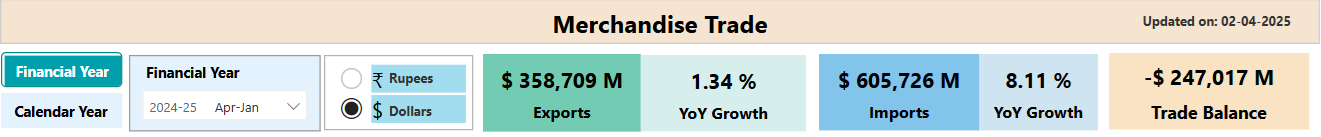

India is a net importer country, its exports are only half of the value then imports and as per official data on Government of India website, India exported $358,709M worth of Merchandise and while the Import was almost double to the tune of $605,726M but India’s exports grew only at 1.34% YoY but imports grew at 8.11% YoY, so it clearly concludes that India is net importer country.

Screenshot from Government of India Official website, source.

USA is the 3rd largest investor in India with total FDI inflows of US$ 67.76 billion from April 2000-September 2024.

Besides US imports only 2.7% from India among its total exports versus other countries but in 2023, the United States accounted for approximately 6.26% of India’s total merchandise imports, amounting to around $42 billion out of India’s total imports of $672 billion.

This positioned the U.S. as India’s third-largest supplier of imported goods, following China (18.1%) and Russia (9.97%). The primary categories of goods imported by India include mineral fuels, electrical machinery, and precious stones. Hence, charging 26% tariffs to the country which is already struggling with its exports is not fair and not good for friendship.

Trump needs to understand, he is not running a business where he has to only think about profit, he is running a country which is arguably most powerful country in the world and whatever US does it has a worldwide effect.

To keep China in check, US needs India as an ally, but with decisions like these, trust and friendship is difficult to grow. Besides US needs India to be strong both finances and military power, so both US and India together can counter China’s growing power and influence.

Misunderstanding Reciprocity

1. Tariffs are not just “mirrored numbers.” Countries impose tariffs based on domestic policies, economic development levels, and global trade agreements.

2. India is classified as a developing country, so under WTO rules, it’s allowed to have higher tariffs on certain goods than developed nations like the U.S.

3. Tariffs are not always one-to-one or equal across trading partners.

4. India and the U.S. are at different stages of economic development. India often has higher tariffs to protect its growing domestic industries, which is a common practice among developing economies.

5. The U.S., as a developed economy, has lower average tariffs and stronger industries that can handle global competition.

WTO Rules and Trade Agreements

1. The U.S. and India are both members of the World Trade Organization (WTO). Under WTO rules:

2. Countries agree to maximum bound tariff rates.

3. The U.S. cannot arbitrarily raise tariffs beyond its WTO commitments unless it exits the agreement or justifies under national security/emergency clauses (which are controversial and can invite retaliation).

Doesn’t Reflect Real Trade Balances

1. The U.S. has a trade deficit with India, but it’s not extreme (around $40B in goods in 2023).

This image is from Official US government website, with official figures. Source.

2. Much of India’s tariff regime is driven by its need to protect small farmers and manufacturers, not to hurt the U.S.

A Better Approach?

1. Use bilateral trade talks to reduce trade imbalances or address specific market access issues.

2. Work through WTO mechanisms or leverage strategic incentives (like tech transfer, visas, investments).

3. Understand that tariff disparity doesn’t equal unfairness—context matters.

Read more about Tariff impacts on India click here.